About

Background

I am a science and technology oriented person with a unique blend of academic and professional experience. I hold a PhD in Mechanical Engineering with a specialization in Computational Mechanics and have made significant contributions to the development of advanced mathematical models for simulating sound in lattice composites (PhD thesis and Google Scholar). Additionally, I have over 5 years of experience working in the world’s leading semiconductor manufacturing industry, where I played a role in designing cutting-edge high precision systems and have multiple patents and defensive publications to my name.

Bitcoin Journey

My introduction to Bitcoin came during the 2017 bull market, a time of feverish excitement around cryptocurrencies. I was captivated by its origin story—its cypherpunk roots, the enigmatic Satoshi Nakamoto, and the groundbreaking invention of Reusable Proof of Work that birthed the world’s first decentralized peer-to-peer ledger technology. However, I lacked a proper framework for understanding its intrinsic value. Spooked by its volatility, I sold all my Bitcoin after a modest profit.

My interest in Bitcoin faded until the 2021 bull market reignited my curiosity. This time, I made a bigger mistake: I dismissed Bitcoin as outdated and dove into altcoins, seduced by the DeFi hype. I believed Bitcoin was too primitive to compete in the era of smart contracts and programmable money. The 2022 bear market crash proved me wrong. Most altcoins plummeted, exposing the crypto industry as largely speculative with little real-world utility. Bitcoin maximalists’ warnings about “shitcoins” rang true, and I paid the price for my misjudgment.

That crash was a turning point. Despite Bitcoin’s drop from $69,000 to around $15,000, I saw its resilience and antifragility shine through. From a risk-adjusted return perspective, Bitcoin stood out as the strongest asset class, especially compared to traditional investments when accounting for tail risks. My perspective deepened in 2023 when Bitcoin’s price surged amid the Silicon Valley Bank collapse, underscoring its role as a hedge in a shifting global macroeconomic landscape. Bitcoin’s design as a secure, finite-supply digital commodity made it the ideal vehicle to transition away from the broken fiat system. The vision of The Bitcoin Standard became my north star.

By 2024, Bitcoin’s rise as a mainstream force was undeniable. The success of Bitcoin ETFs, growing corporate adoption, and its influence on U.S. politics—including the presidential election—cemented its significance. I was all-in on Bitcoin. Investing in stocks, bonds, real estate, or other cryptocurrencies felt outdated and misguided. Holding money in traditional banks seemed obsolete and dystopian compared to the sovereignty and freedom of Bitcoin self-custody.

Bitcoin has been the most transformative invention in my life since the smartphone, and we’re only at the beginning. Like many Bitcoiners, I see it not just as a financial asset but as a force for good — a tool to steer humanity toward a better future. In a world where legacy institutions have faltered, Bitcoin offers hope, vision, and a path to financial sovereignty.

The Website

For years, Bitcoin’s price puzzled me, even as I accumulated it. I was certain it would rise significantly, but the “when” and “how” remained elusive. This uncertainty is widespread among Bitcoiners, many of whom eschew predictive models, guided by the mantra “stay humble and stack sats.” While this approach suits beginners using dollar-cost averaging, experienced investors often seek data-driven models to manage their portfolio. As the saying goes, “All models are wrong, but some are useful.” A predictive model grounded in robust principles and validated against data can be invaluable, even if imperfect.

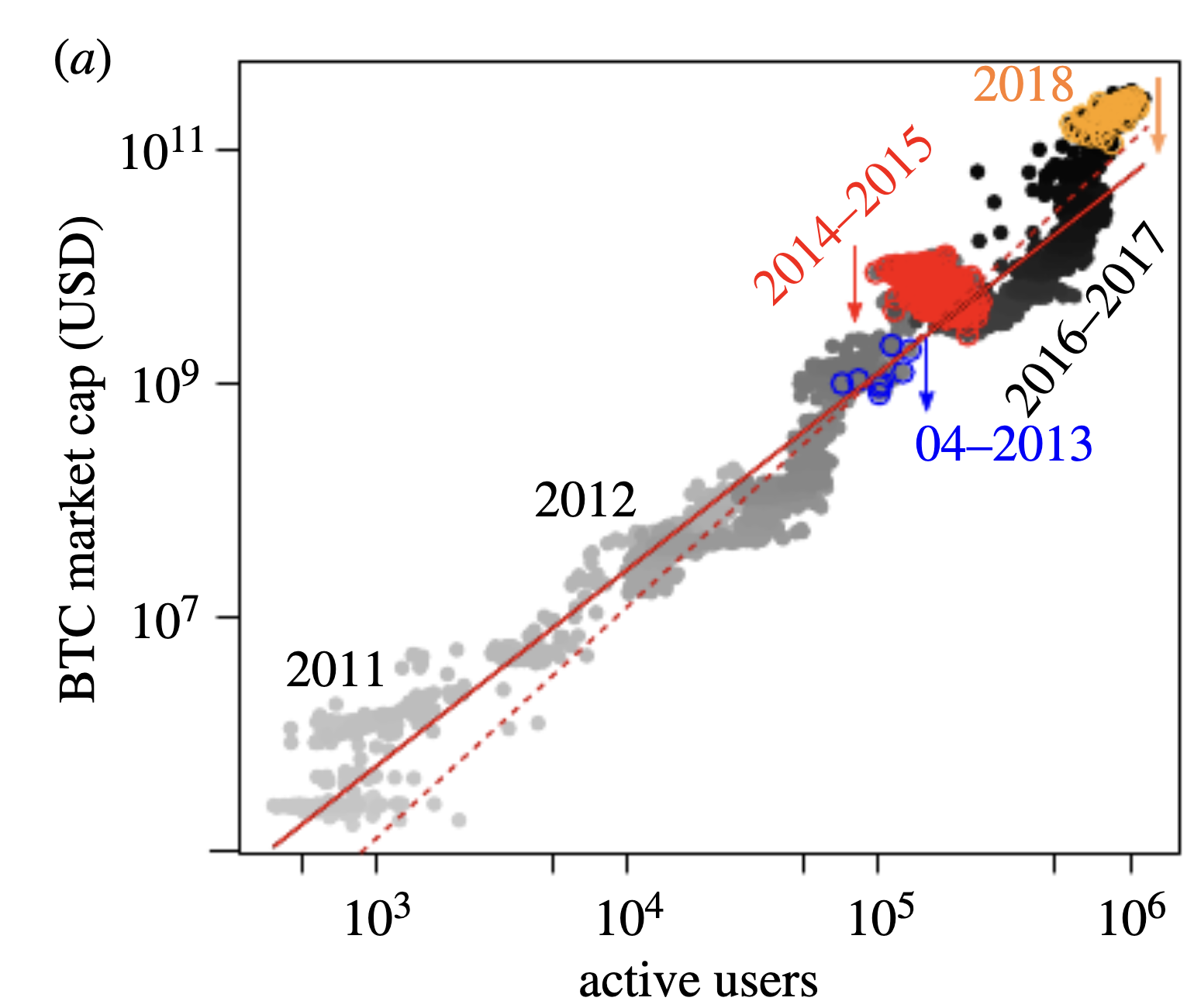

I started investigating price models around 2024 when I encountered the power law price model, popularized by Giovanni Santostasi and many others on YouTube and Twitter/X. Unlike the well known, but flawed Stock-to-Flow (S2F) model, the power law offered remarkable accuracy for long-term price forecasting and deeper insights into price bubbles and Bitcoin’s four-year cycle. Further research introduced me to Wheatley et al.’s work, which demonstrated Metcalfe’s Law on Bitcoin by linking its price to the square of active addresses. This revealed that Bitcoin’s price power law relationship emerges from its network structure and dynamics, providing a stronger theoretical foundation than supply-driven models like S2F.

Wheatley et al. (2018) - Bitcoin price versus active addresses showing a strong correlation. The slope of the fit is approximately 2, suggesting a Metcalfe’s Law relationship.

Wheatley et al. (2018) - Bitcoin price versus active addresses showing a strong correlation. The slope of the fit is approximately 2, suggesting a Metcalfe’s Law relationship.

Inspired by these insights, I began exploring the power law model, sharing my findings on Twitter/X and earning positive feedback from the Bitcoin community. I also created free online tools based on this model, enabling users to estimate future net worth and income from their Bitcoin strategies. The enthusiasm for rational, data-driven analysis among Bitcoiners inspired the next step in my journey. Bitcoin’s unique, physics-driven price dynamics offers an opportunity to develop a scientific approach to valuation, blending traditional finance methods with novel theories. This approach aims to deliver better capital management strategies for individual Bitcoiners and institutional investors.

This website is my platform to pioneer this domain. Here, I’ll publish exploratory articles, sharing early drafts, data analyses, and validation studies. I also aim to build practical financial tools based on my research. Join me in shaping Bitcoin’s future—follow updates on Twitter/X or Nostr Primal, share your thoughts in the comments section of each article, and support my work via Lightning payments ⚡️.

Ashwin Sridhar

Disclaimer: The content on this website is for educational and informational purposes only. Nothing contained here constitutes financial advice, investment recommendations, or professional consulting services. All information is provided “as is” without warranty of any kind. Before making any investment decisions, please conduct your own research and consult with qualified financial professionals.